njtaxation.org property tax relief homestead benefit

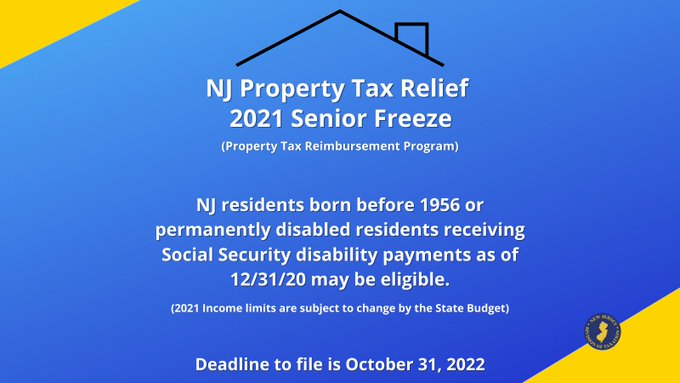

If you have questions about the Senior Freeze Program and need to speak to a Division representative contact the Senior Freeze Property Tax Reimbursement Hotline. To file an application on line visit.

This years shorting of Homestead benefits would come after the average New Jersey property-tax bill rose last year by nearly 160 year-over-year to a record high of 9112 according to the most recent data from the New Jersey Department of Community Affairs.

. We recommend that you do not include your full social security number. If you need to check the status of your homestead benefit for benefit years 2016 2015 or 2014 click hereTo check the status of your homestead rebate for 2017 call 877-658-2972. The system will also indicate whether the benefit was applied to your property tax bill or issued as a check or direct deposit to your.

Your tax collector issues you a property tax bill or advice copy reflecting the amount of your benefit. The Homestead Benefit program provides property tax relief to eligible homeowners. Senior Freeze- the senior freeze program reimburses eligible residents.

For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces what you owe in property tax. This article will go over all NJ property tax relief programs and recommend a personalized guide to help you. Applicants can receive benefits under both programs if they qualify.

Dont Forget to Apply If you are a homeowner whose primary residence is in New Jersey who qualifies by income who paid your 2018 property taxes and who applies by November 30 2021 a NJ Homestead Benefit will be issued as a credit on your 2022 Municipal Property Tax bill. The total amount of property tax relief benefits a homeowner receives however cannot exceed the amount of property taxes paid on their principal. New Jersey homeowners will not receive Homestead property tax credits on their Nov.

Residential Property Owners. If a benefit has been issued the system will tell you the amount of the benefit and the date it was issued. E-mails sent to this address are not sent through a secure server.

New Jersey Property Tax Relief Programs Property Tax Deduction Or Credit Homestead Benefit Senior Freeze Ptr Other Nj-2 Property Tax Relief Programs - Ppt Download. Have a copy of your application available when you call. 1-877-658-2972 When you complete your application you will receive a.

Because the benefit is no longer handled as a rebate it is no longer accounted for on your federal or nj tax returns. 2018 Homestead Benefit payments should be paid to eligible taxpayers beginning in May 2022. Eligibility requirements including income limits and benefits available under this program are subject to.

Property tax relief programs with different eligibility requirements different applications and different filing schedules. Because the benefit is no longer handled as a rebate it is no longer accounted for on your federal or NJ tax returns. The document you are trying to load requires Adobe Reader 8 or higher.

The deadline for filing for the 2017 Homestead Rebate was December 2 2019. Homestead Benefit Online Filing. They are separate property tax relief programs with different eligibility requirements different applications and different filing schedules.

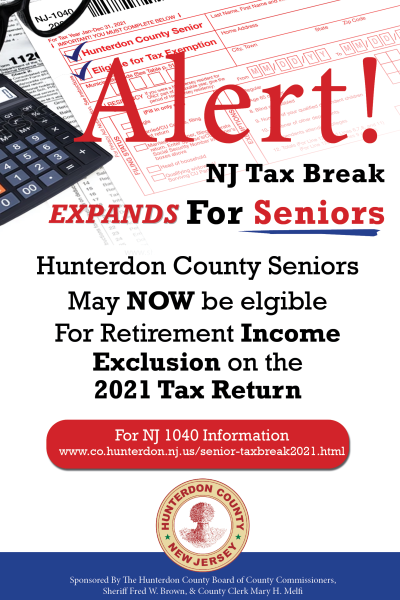

Below are property tax relief programs offered through the State of New Jersey. Property tax relief comes in different shapes and forms in New Jerseyit can be a tax freeze a deduction or a benefit programNJ also provides various property tax exemptions you can apply for to lower your taxes. Njtaxation org online tax relief.

For property tax increases on their principal residence. The Homestead Benefit program provides property tax relief to eligible homeowners. Most recipients get a credit on their tax bills.

1 real estate tax bills a state treasury official said Wednesday. Residents should not confuse the Homestead Benefit Program with the Senior Freeze Property Tax Reimbursement Program. To file an application by phone1-877-658-2972.

Property Tax Relief Programs. Below are property tax relief programs offered through the State of New Jersey. Senior Freeze- the senior freeze program reimburses eligible residents for property tax increases on their principal residence.

For most homeowners the benefit is distributed to your municipality in the form of a credit which reduces your property taxes. The total amount of all property tax relief benefits you receive Homestead Benefit Senior Freeze Property Tax Deduction for senior citizensdisabled persons and Property Tax Deduction for veterans cannot be more than the property taxes paid on your. The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 - was November 30 2021.

NJ Property Tax ReliefA Relief for Your Wallet. When you report your property taxes paid you already account for this benefit. The OTA will contact you if additional information is.

How to File for Property Tax Relief and Check Your Status. Credit on Property Tax Bill. If you filed a 2017 Homestead Benefit application and you are eligible for the same property see ID and PIN.

Applicants can receive benefits under both programs if they qualify. If you did not receive a 2018 Homestead Benefit mailer and you owned a home in New Jersey on October 1 2018 that was your main home call the number above for help. Search here for information on the status of your homeowner benefit.

Check or Direct Deposit. The NJ Homestead Benefit reduces the taxes that you are billed. You may not have the Adobe Reader installed or your viewing environment may not be properly.

Office of the Taxpayer Advocate OTA PO. Amounts you receive under the Homestead Benefit Program are in addition to the States other property tax relief programs. New Jersey property tax keeps climbing.

File Online or by Phone.

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

These Are Some Updates On Your Homestead Exemption New Homeowners You Can Start Filing Your Homestead Exemption Now A In 2022 New Homeowner Homeowner Home Buying

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

Property Tax Relief Programs West Amwell Nj

State Of Nj Department Of The Treasury Division Of Taxation

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

Property Tax Relief Programs West Amwell Nj

Property Tax Deduction Credit Eligibility Requirements All The Following Must Be Met You Must Have Been Domiciled And Maintained A Principal Residence Ppt Download

Download Instructions For Form Nj 1040 New Jersey Resident Income Tax Return Pdf 2020 Templateroller

Don T Forget To File Your Homestead Exemption Your Application Must Be Applied For On Or Before April 29 2018 Real Estate Investing Homesteading Real Estate

Nj Property Tax Relief Program Updates Access Wealth

Memoli Company Pc Home Facebook

Ppt New Jersey Property Tax Relief Programs Powerpoint Presentation Free Download Id 4440099